Lebard

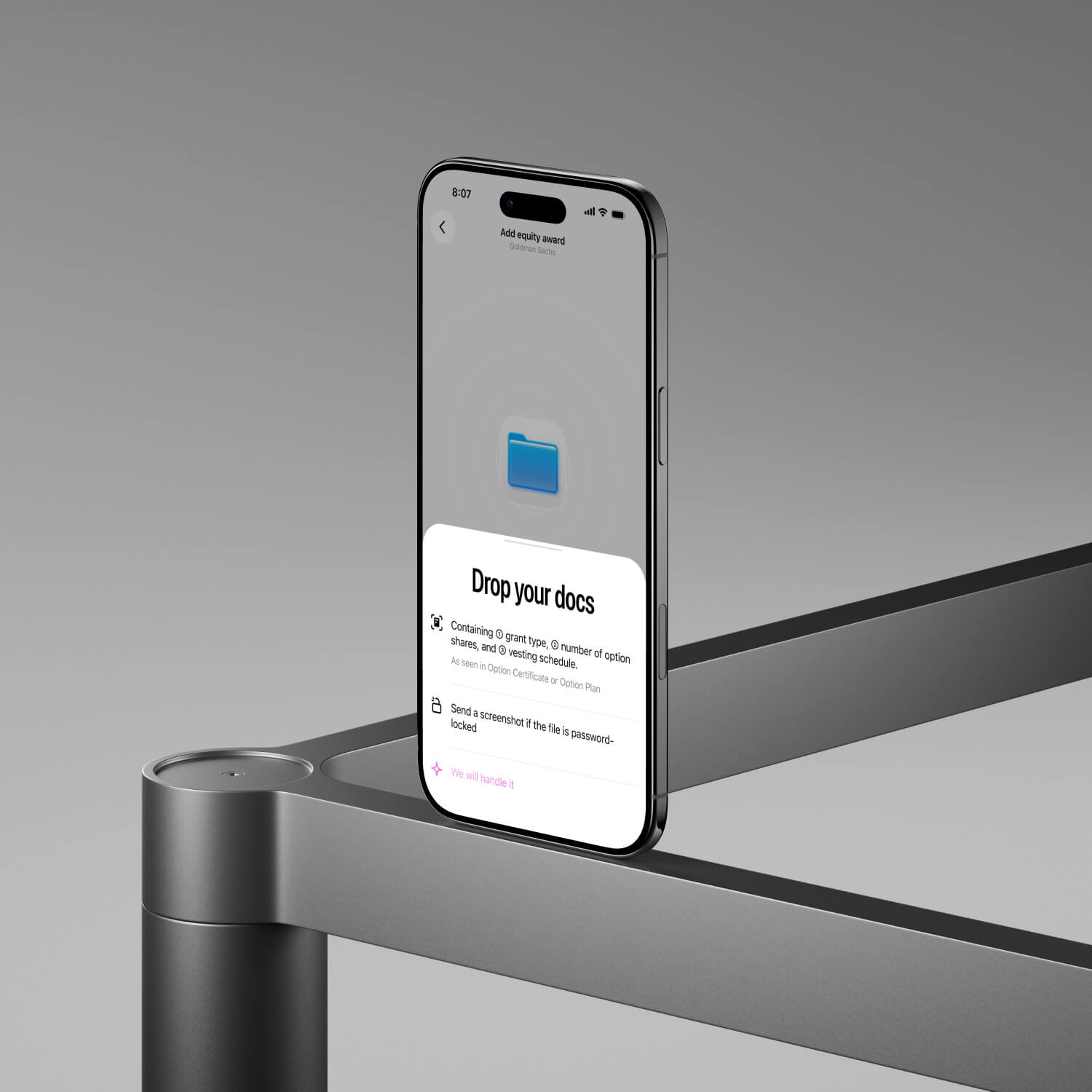

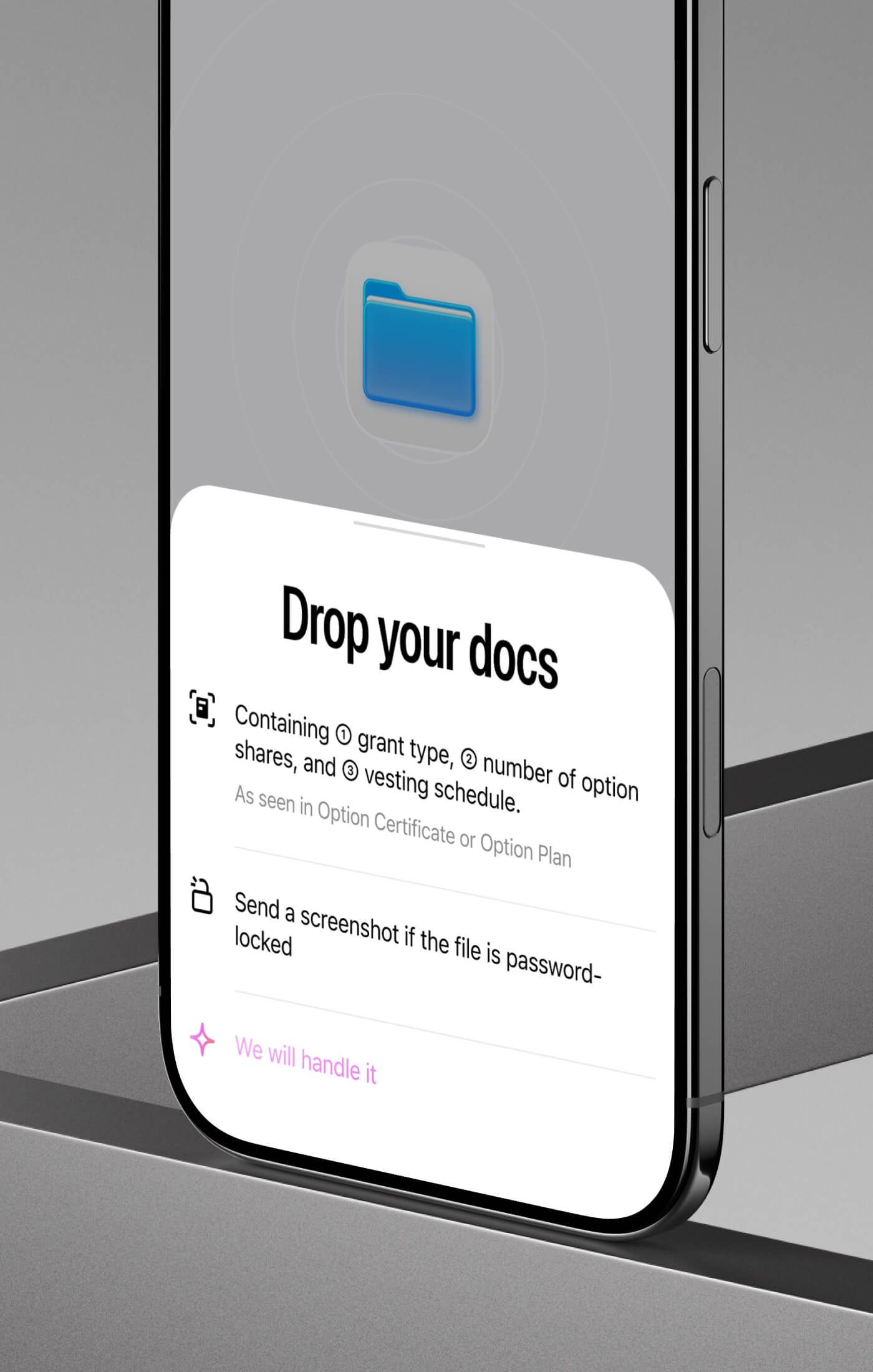

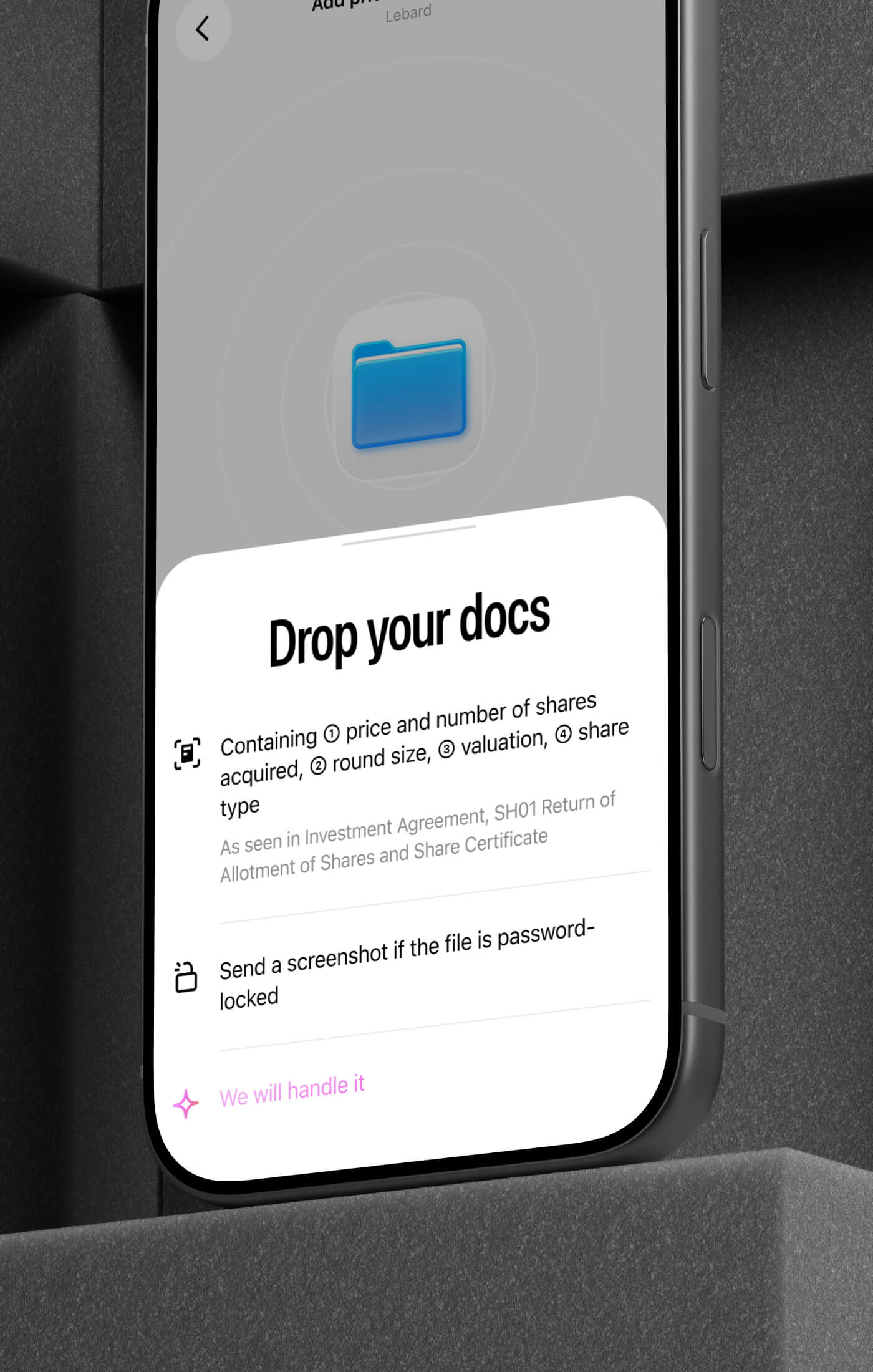

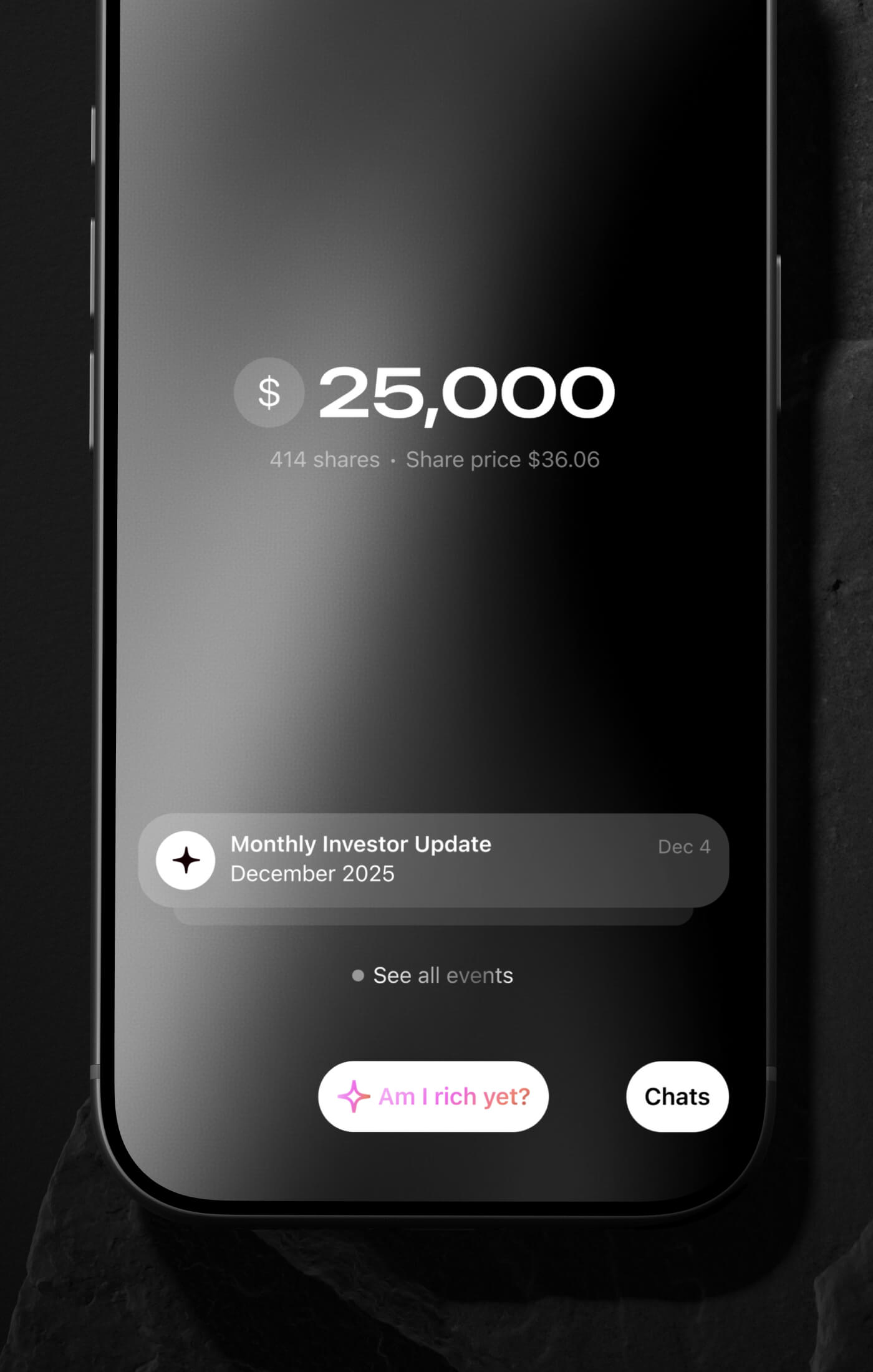

From paper to wealth

Enjoyed by early employees and professionals from Copper, Monzo, J.P. Morgan, AWS, Disney AI and many more affluents who like control

ready when you are

Legal Agent

If you sell now, 1,114 shares will be delivered - but only 774 are sellable. The rest are still under holding restrictions.

Investment Analyst

The shares are trading at $565 and are quite liquid. That’s roughly $437,310 gross, including dividends. Details

Tax Agent

With a 52% effective tax rate, your net would be around $209,908. Details

Risk Analyst

Your stock options are in USD, but the mortgage is in GBP — so you're taking on FX exposure. Details

Head of Family Office

After the sale, your total wealth would be around $2,209,908 out of which 20% in liquid assets

But a few flags:

You have a $140k obligation due in February — let me know if you want me to factor that into your cash flow.

Your stock options are in USD, but the mortgage is in GBP — you’re taking on FX exposure.

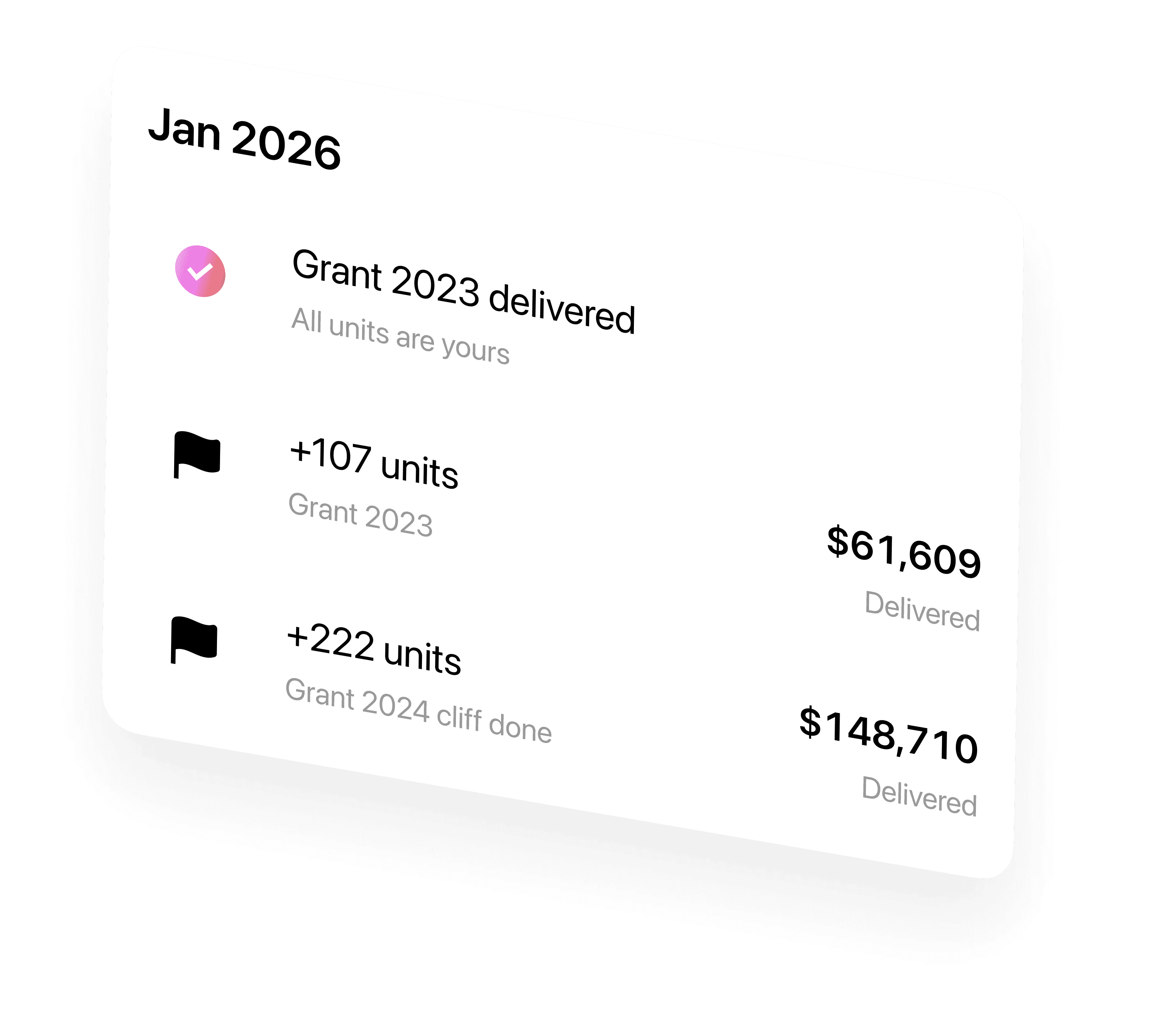

wealth pockets

Every story is unique. We handle any asset, in any form

Pension Plan

Soon

Real Estate

Soon

Banks

Soon

Brokers

Soon

…more

Climbing up is hard – not slipping is harder

Enter your email to access the closed beta